Ad Tax Depreciation Schedules Produce One Of The Highest Tax Savings For Investment Property. Ad Get Unlimited Tax Deduction Questions Answered Online Save Time.

Tax Depreciation Schedule Adelaide

At Washington Brown Quantity Surveyors we provide quantity surveying tax depreciation and building insurance valuations for property investors property developers and strata managers in Adelaide and surrounding regions including Whyalla Victor Harbour Glenelg Mount Barker Murray Bridge Gawler Elizabeth.

Tax depreciation schedules adelaide. An ATO compliance report is a depreciation schedule that enables investors to deduct write off claims for new and existing properties for intensive tax purposes. An ATO compliance report is a depreciation schedule that enables investors to deduct write off claims for new and existing properties for intensive tax purposes. Ad A Property Depreciation Schedule Provides Great Tax Savings For Your Investment Property.

At My Depreciation we deal solely with depreciation schedules and offer a national service to clients in all metropolitan and most regional areas. A depreciation schedule is in report that lists the depreciable assets related to owning an investment property including the building itself. Ad If you cant get a refund worth twice the fee it costs you nothing.

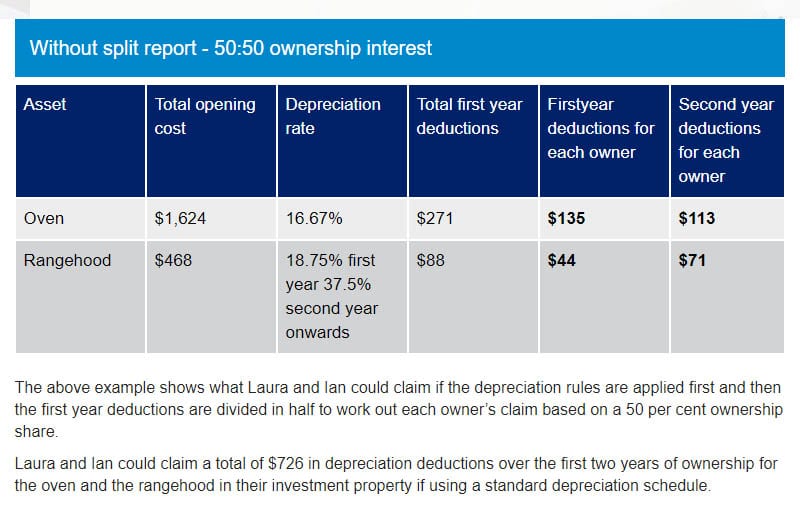

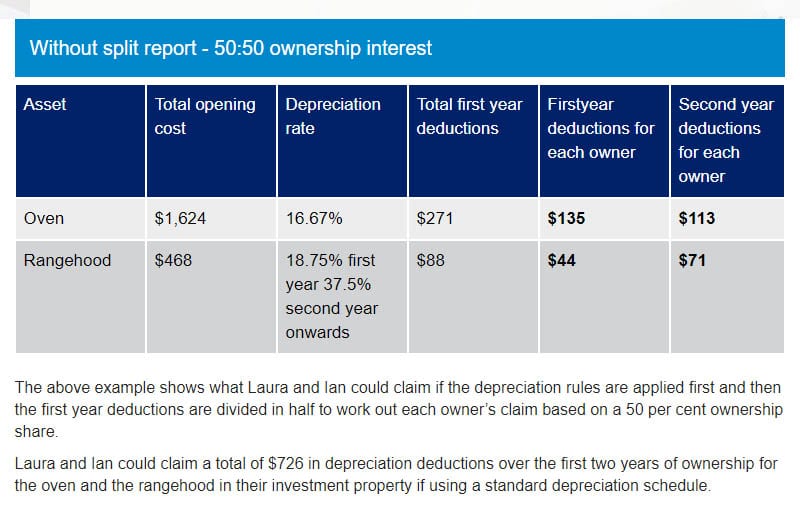

Tax depreciation schedules list all of the depreciable assets related to owning a property including the building itself. Looking for tax depreciation schedules Adelaide. Our reports are prepared by experienced and registered quantity surveyors.

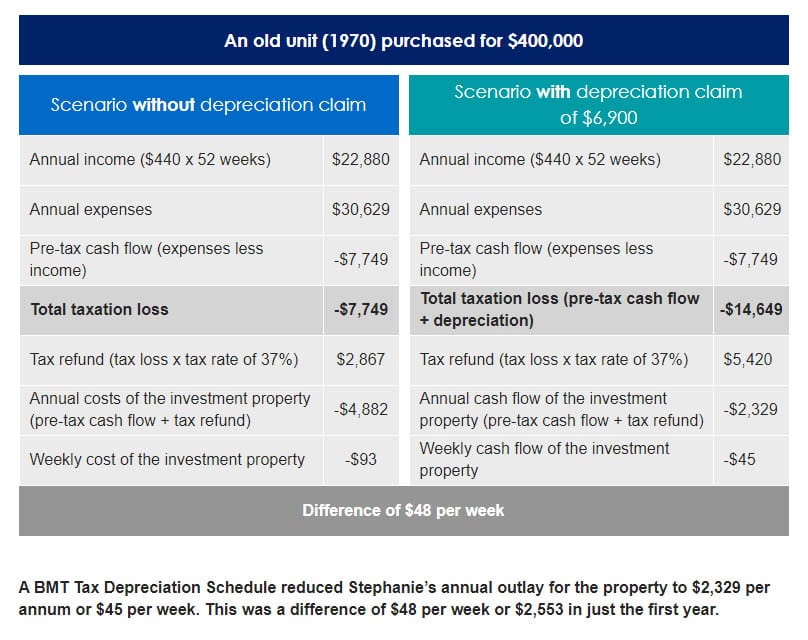

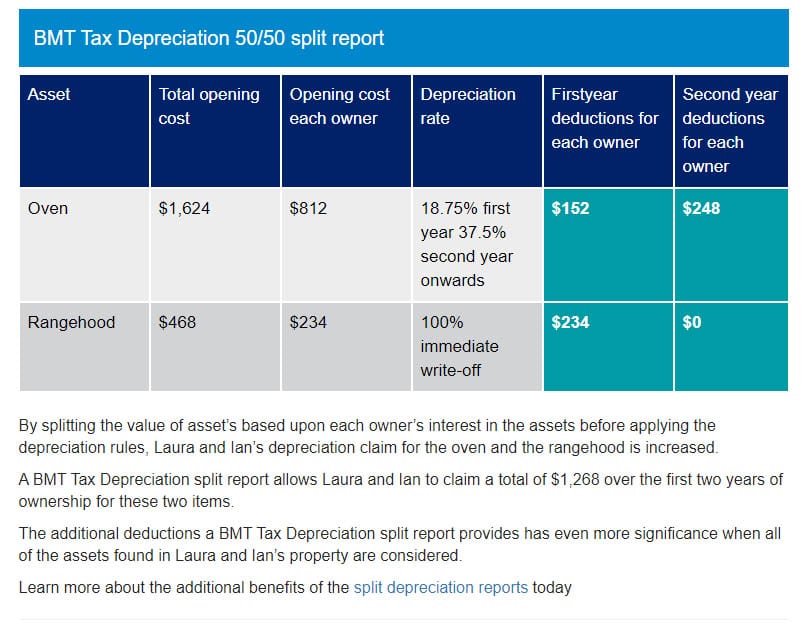

A tax depreciation schedule Adelaide report refers to a document that outlines all potential depreciable assets for a commercial or residential investment property. Adelaide CBD Adelaide Adelaide University North Adelaide Bowden Mile End Cowandilla Clarence Park Ashford Hyde Park Eastwood Dulwich Beulah Park College Park. BMT Tax Depreciation Quantity Surveyors provides schedules for owners of investment properties across Adelaide helping them to increase their cash return.

Dont You Miss Out. This report can also be used to calculate the amount you can depreciate on your tax return each year based on your allowances. It tell you or your accountant what tax to claim when putting in your tax return to ensure you claim the correct amount of tax back.

Ad Tax Depreciation Schedules Produce One Of The Highest Tax Savings For Investment Property. Rely on BMT for depreciation schedule accuracy and increased cash flow. Ad A Property Depreciation Schedule Provides Great Tax Savings For Your Investment Property.

We are here to make the process fast easy and affordable while still offering the expertise of quantity surveyors who are up to date with Australian Tax. Dont You Miss Out. Thousands Of Aussies Have Saved Via A Tax Depreciation Schedule.

A Tax Depreciation Schedule is a report which allows you to claim back the depreciation costs of your income producing property. What is a Tax Depreciation Schedule. Ad If you cant get a refund worth twice the fee it costs you nothing.

Need a Property Depreciation Schedule in Adelaide. This report can also be used to calculate the amount you can depreciate on your tax return each year based on your allowances. Tax Depreciation Schedules Adelaide are one of the industry leaders.

Our office hours have been extended to 7pm until June 30. You can call us 1300 697 857. Ad Get Unlimited Tax Deduction Questions Answered Online Save Time.

Tax Depreciation Experts Adelaide Enterprises is Australias Leading Online Discount depreciation schedule provider with over 20 years experience. The depreciation schedule covers the structural building and items such as appliances and fittings within it it does not cover personal items such as furniture. Thousands Of Aussies Have Saved Via A Tax Depreciation Schedule.

Depreciation And Off The Plan Properties Bmt Insider

Adelaide Tax Depreciation Schedules Depreciation Reports Deppro

Tax Depreciation Schedule Adelaide

Tax Depreciation Schedule Adelaide

Tax Depreciation Schedule Adelaide

Investment Property Tax Depreciation 2 Crucial Things To Consider Before Living In Your New Property Duo Tax Quantity Surveyors

0 Comments